In the world of finance, there are many terms you must understand to make informed financial decisions.

Here are a few of them:

A

i.) Assets: anything owned by an individual or company that holds value and can be used to generate income or profits.

ii) Asset Allocation: A strategy to create a diversified investment portfolio by investing in different asset classes like stocks, bonds, and commodities.

B

i.) Bonds: Debt securities issued by companies, municipalities, or governments to raise capital.

ii.) Bull and Bear Markets: A bull market is a market in which security prices are rising, while a bear market is a market in which security prices are falling.

C

Capital: Money or assets used to generate income or profits. Compound Interest: Interest that is added to the principal amount and then recalculated on a new larger amount. It leads to higher returns on investment over long periods.

D

i.) Dividend: A payment made by a company to its shareholders as a distribution of the company’s profits or earnings.

ii.) Diversification: Investing in multiple assets to reduce the risk of loss from any single asset. It is a commonly employed investment strategy that helps investors manage risk.

E

Equity: Ownership interest in a company, represented by shares of stock.

F

Financial Statements: reports that provide an overview of a company’s financial position, including balance sheets, income statements, and cash flow statements.

G

Gross Domestic Product (GDP): the total value of goods and services produced within a country’s borders.

H

Hedge Fund: An investment fund that pools capital from accredited investors or institutional investors and invests in a variety of assets, often using complex investment strategies.

I

Interest Rate: The percentage amount charged by a lender to a borrower for the use of money.

J

Junk Bonds: Low-rated bonds with high yields, often issued by companies with poor credit ratings.

K

Keynesian Economics: An economic theory that advocates for government intervention in the economy to promote economic growth and stability.

L

Leverage: The use of borrowed money or assets to increase potential returns or profits.

M

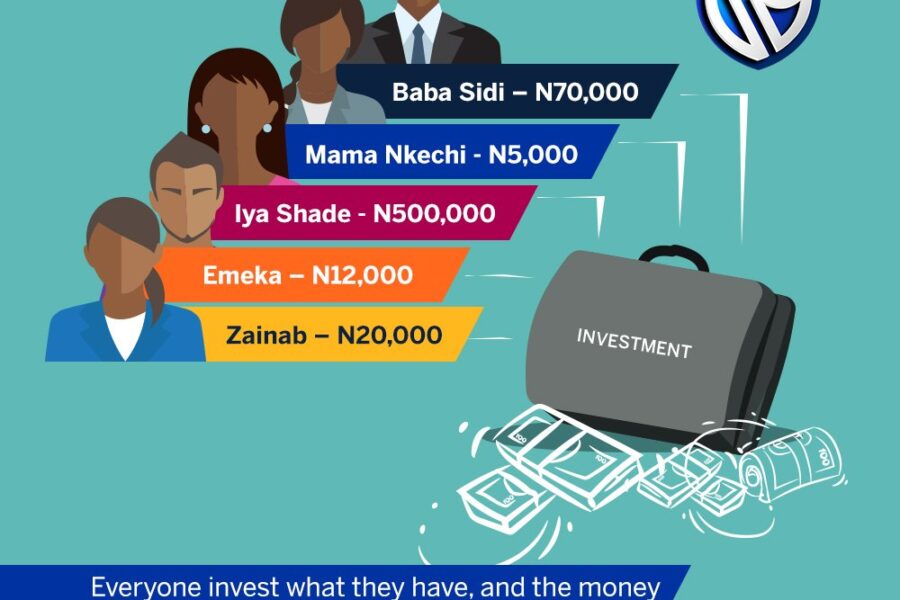

Mutual Fund: An investment fund that pools money from multiple individual investors and invests in a diversified portfolio of stocks, bonds, and other securities.

Sign up or sign in here to buy mutual funds

N

NSE: The Nigerian Stock Exchange is the principal securities exchange of Nigeria

O

Options: Financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price at or before a specific date.

P

Portfolio: The collection of stocks, bonds, and other securities a person or entity owns.

Q

Quantitative easing: The action taken by central banks to increase the supply of money in the economy and promote economic growth.

R

Return on investment (ROI): The amount of profit or loss generated relative to the amount of money invested.

S

Stock: A share in the ownership of a company.

T

Treasury Bills (T-Bills): Short-term government securities that mature in less than one year.

Sign up or sign in here to buy T bills

U

Underwriter: A financial firm that helps organisations sell new securities to the public.

V

Venture Capital: capital invested in a start-up or early-stage company with the potential for high returns.

W

Wall Street: A street in lower Manhattan that is home to the New York Stock Exchange and many financial institutions.

X

eXchange-Traded Fund (ETF): A type of investment fund traded on stock exchanges, created to track the performance of a specific index or sector.

Y

Yield: The amount of income generated by an investment, typically expressed as a percentage of the investment amount.

Z

Zero-Coupon Bond: A bond that pays no interest during its maturity and is sold at a discount to its face value.

The list and terms above are inexhaustive. Sign up for our mailing list to get more insights