Hello, let’s talk about that word that makes everyone cringe, budget.

Forget those complicated Excel sheets that feel like homework. We are ditching the shame and creating a budget that actually fits your real Nigerian life, not some impossible fantasy. Your money is getting wasted because you don’t tell it what to do. iykyk.

Here’s the tea: a budget is not about restricting you; it’s about giving you freedom to spend without guilt, because you’ve already taken care of the important things. It’s your map to financial power.

Step 1: track the leakage (it’s not always what you think) 🕵️♀️

Before you cut anything, you need to know where your money is going.

- The ignorance trap: most people overestimate how much they spend on major bills (such as rent) and massively underestimate the small expenses (like daily transportation, impulse snacks, and subscription fees). Those small things are the leaks!

- Find your number: Track every kobo for one full month. Just write it down. This is the hardest part, but once you face the facts, you can take control.

Step 2: the soft-life budget rule (20/50/30 flip) 🤩

We are flipping the script to prioritise your future comfort and financial peace first.

- 20% financial power first: this is the money you immediately send to your savings and investment accounts. This is non-negotiable! Pay the future you first.

- 50% needs (the essentials): rent, food, transportation, utilities, and debt payments. Be realistic here. If your rent is too high for 50%, you may need to adjust the ‘wants’ or seek new income.

- 30% wants & fun: this is your soft-life money! dining out, weekend trips, data, new shoes, or supporting your family. Because you already paid your future self, you can spend this 30% guilt-free.

Step 3: automate and chill (a true soft flex) ✨

The secret to making this budget work is taking the work out of it.

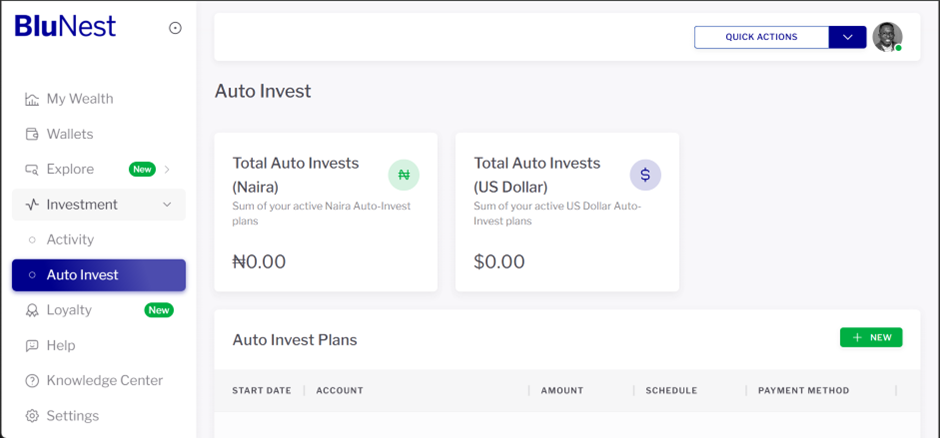

- Automate your 20%: set up automatic transfers to your investment platform (like BluNest auto-invest) the day your salary lands. You won’t miss what you don’t see.

- The envelope method (digital style): use separate accounts or digital “vaults” within your banking/savings app for your needs (like BluNest wallet), wants, and power money. Once the “wants” account is empty, stop spending until the next cycle.

Don’t let money stress you out anymore. A budget isn’t a cage; it’s the structure that guarantees your future freedom and allows you to enjoy the present without worry. start building that structure today 🛠️.

Ready to start investing smart? Try BluNest auto-invest today and let your money grow while you sleep. Got questions about budgeting tips for Nigerians? Drop them in the comments or DM us on Instagram @Beyonddreamsng.