Let’s be honest 😮💨, nothing hurts like watching your salary land today and vanish faster than PHCN light during a Champions League final. One minute you’re basking in the glow of that “credit alert” notification, the next you’re at your favourite restaurant, buying data, and sorting “urgent” necessities that apparently could not wait.

Then the mental gymnastics begin🤸🏾.

“Abeg, it’s not me — it’s this economy jare! If I just “japa” to somewhere better, where pay is solid, prices are normal, and my village people can’t find my location, “life go soft.”👍🏾😌”

My dear, please snap out of that daydream before “delulu” becomes the “solulu” and gives you even more wahala🤧.

Because that gut‑punch moment when you check your account and whisper, “Who turned on disappearing money mode?”, reality check — the culprit might just be you. The good news is you can flip the script.

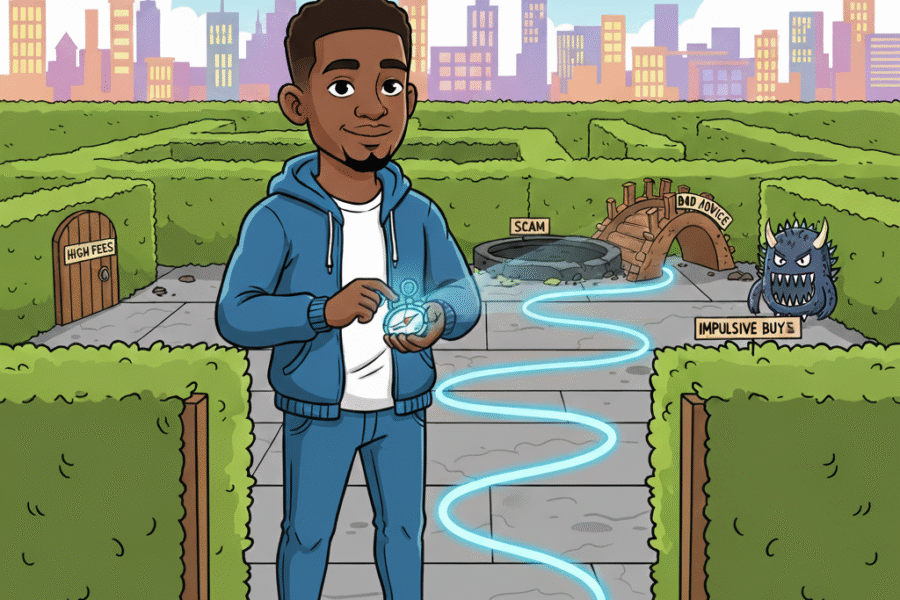

Here’s how to move from “money controlling me” to “I run this bag”:

- Know your Income: Not just the money you’re paid from work 💼. Focus on the part that actually stays in your control after the bills, transport, and must‑pay stuff.

Example: If you earn ₦100k but only ₦20k remains after expenses, that ₦20k is your kingdom. Know how often it arrives and whether it’s steady. Your game plan starts from there.

- Budget Wisely: Budgeting isn’t punishment ooo 🙅🏾

It’s power over your money. Decide ahead what every naira will do. Essentials first (food, rent, transport, data), then rank what’s left by priority.

And yes, add a line for enjoyment. Because if you cut “soft life” entirely, you’ll blow up your own plan faster than you can say “Lagos traffic”.

- Save that money: Instead of waiting till you have plenty, throw in what you can, even if it’s loose change 🫰🏾. Spending the little you have on something unimportant will end up as wasted potential, but gradually piling it all together will give it purpose😉.

- Dream it, track it: Set clear financial goals and monitor your progress. New phone? Travel fund? Emergency stash? Write it down, check in often. When the “abeg, forget it” thoughts creep in, that vision will keep you focused.

- Manage debt: Some debts are just financial black holes 🕳️. If you must borrow, make sure you use it for an asset like a business and not a liability like a phone🚶🏾😮💨. Check your ability to pay back the loan so as not to ruin your credit score.

- INVEST: Leaving cash idle is like leaving suya outside overnight — the value will disappear. Explore investments like bonds, mutual funds, stocks, and pensions. They grow over time, but always weigh the risks before jumping in.

- Protect your assets: Life happens, especially when it’s unexpected😬. Maybe a phone drop, a car accident or a hospital bill. Get legit insurance to protect what matters: health, life, car, property. A single click or accident shouldn’t wipe you out.

- Set boundaries: Say no to every random hangout, impulsive online cart, or “urgent” loan to impress. Trends will pass, but brokenness is a long‑term vibe you don’t want.

“Set those boundaries today so your tomorrow can chop life 😎”

Enjoying life is a must, but not at the cost of financial chaos. Managing your money isn’t about being stingy; it’s about being smart enough to call the shots and striking a balance.

You’re the CEO of your own wallet, and every naira should answer to you.

‘Because, abeg, nor be everyday you go dey soak garri till your eyes dey pain you — the shege you’ve seen is enough😭.’

Now it’s time to start seeing results ✅