We observed some similarities between the swindler phenomenon and investment schemes that turn out to be fraudulent. We have highlighted five ways to avoid falling victim to them.

1. Due diligence is EXTREMELY important: Don’t warm up too quickly to strangers without fact-checking from multiple independent sources. The same goes for investment opportunities.

2. Appearances can be deceiving: Swindlers are usually well dressed, lavish and often generous to potential victims. This is basically laying the foundation for when they would eventually ask for money they wouldn’t pay back. Don’t get overwhelmed by actions and promises that appear too good to be true.

3. Maintain mystery around your finances: Victims are targeted because they appear comfortable. While it’s important to live your best life- don’t let perceptions gleaned from your online activity draw a fraudster’s attention to you.

4. Be wary of confidence tricksters: They usually confide in their victims to earn trust by sharing fictional stories about hardships. Things always seem urgent when they require you to part with money, so you might not have time to think rationally about the decision.

5. Recognise red flags early, ’shine you eye’: Swindlers repeatedly borrow money and continue to lavish it. They may likely suggest you engage in illegal activities for money and in some scenarios, resort to threatening the victims till they ‘’ghost’’ you and become unreachable. Predictably, they will also not satisfy their obligations when it falls due.

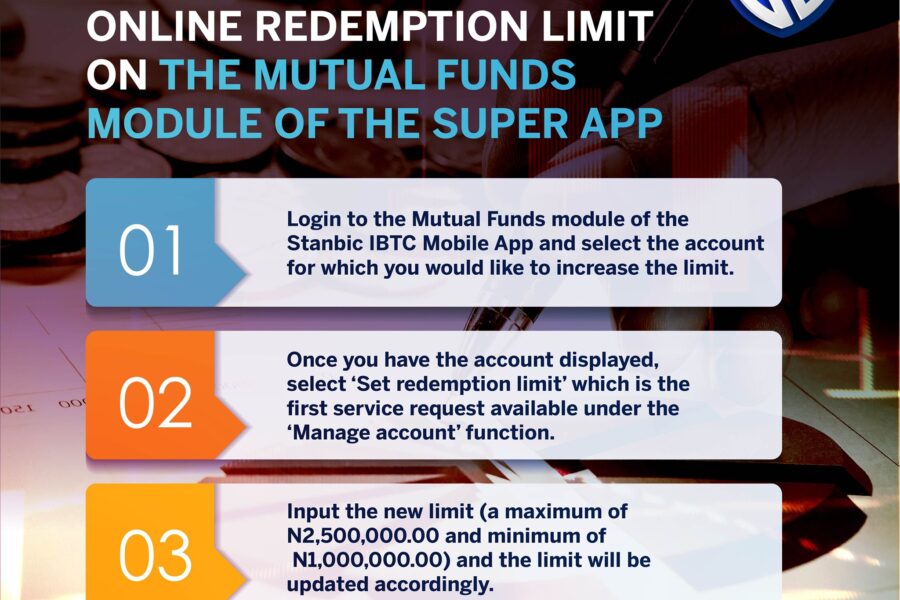

Like investment companies that court you to invest with promises of high returns within a short time, a money swindler can also be someone in your life who regularly “borrows” from you. Please stay on guard. Save diligently in your period of abundance, by keeping your excess cash in a Stanbic IBTC mutual fund for your emergency needs. Log in to your existing account to top up your investment or open one here with as little as ₦5,000